|

$6,833. That's how much you can make EVERY MONTH for the next 12 months – using an investing strategy so easy and effective that Forbes says it's "like finding money in the street." I've used it to pull in $282,320 in extra cash since April 2011. Find out more here.

| |  | 10/08/2014 By Jim Fink

What if I told you that you could start collecting guaranteed income of $6,833 a month—and you'd only have to spare 9 minutes a week to do it?

That works out to an extra $82,000 a year.

I know. Sounds too good to be true, right?

But before you write me off as crazy, you should know that there is a group of investors who are pulling in this much and more right now—putting an end to their income worries forever.

People like my friend Roger. My hunch is you probably know someone just like him.

Roger worked hard all his life. By the end of his career, he'd built a successful real estate business and thought he was set for retirement.

But unfortunately for Roger, it was 2008. Right when the real estate market "went to hell in a handbasket," as he puts it.

Suddenly, the value of his business simply evaporated, and he was faced with the prospect of living on Social Security—and very little else.

That's when he discovered this new way of making steady monthly income. He started out small, but he still made an extra $30,000 that first year.

He kept at it, investing more as he got comfortable trading. This year, he's on pace to pull in just under $200,000.

And Roger's not the only one pocketing six figures from this hugely profitable strategy...

Welcome to the "New Baby Boomer Hobby"

This way of investing has become so popular among the over-50 crowd that Reuters calls it the "new Baby Boomer hobby."

There's a good reason why it's so popular: because it lets you pull in payouts like $5,550 … $9,970 … even $13,100 … month after month after month.

Those aren't hypothetical numbers.

That's how much you could have collected using this strategy in just the first three months of this year.

And it's just the beginning. I know, because I helped people pull in $282,320 in extra cash from April 21, 2011, to September 19, 2014, with less risk than trading stocks.

That's an average of $6,885 every month in extra cash. Of course, some months you collect less. And some months you collect more.

But here's the bottom line: If you'd started trading with me in April 2011 and followed every recommendation I made, you could have pulled in around $82,620 each year in extra cash.

And it really would have taken you just 9 minutes a week.

So how what's the secret?

Trading options. That's right. Options!

Unleash the Profit-Making Power of Options—Without the Risk

Now if you're like some investors I know, you may have thought about trading options before but worried that it was too risky or complicated.

But before you run away screaming, stay with me for a moment.

Because remember my friend Roger?

He didn't start trading options until after he retired. He was one of the first to subscribe to my Options for Income service when I launched it in April 2011. I've gotten to know him quite well over the years.

He tells me he's made enough money to never worry about paying bills, fixing the house, paying for his granddaughter's education or helping out his older kids when they hit a rough patch.

Like Roger, many Options for Income subscribers had never traded options before. They're making this kind of cash by simply trading the step-by-step recommendations I send them.

And here's what the numbers say about the results: - Subscribers who've been with my service since April 2011 have received 273 trades. And 231 of them were winners. That's an 84.6% win rate—unheard of for investors in stocks, options or anything else!

- We've gone long stretches without banking a single losing trade. Like between October 2012 and August 2013, when we didn't have any losers. Not one.

- Investors who followed my instructions collected $362,990 in cash and paid $80,670 to cover losing trades. So our net profit is $282,320 (excluding commissions), based on 10 contracts per trade.

In a moment, I'll show you how you can join this group with no risk whatsoever—and benefit from a guarantee unlike any you'll find anywhere else.

But right now I want to let you in on…

The Secret Behind an $82,000 Annual Windfall

The strategy that produced these stunning results is the same one I used to turn $50,000 into $5.3 million, allowing me to quit my day job as a lawyer and trade options full-time.

I can sum it up in five words: don't buy options. Sell them.

Studies show that options buyers lose money on 7 out of every 10 trades they make. That's because they're mostly speculators. They place high-risk trades hoping for a big payout, and that's why they strike out 70% of the time.

But when you sell options, the odds of winning tilt in your favor. Because every time the buyers strike out, you keep the money. That makes selling options about the closest you can get to almost never losing money when investing.

It really is a snap to take part in these deals. And the money you get is not some loan or advance. Once the funds land in your account, they're yours to keep.

No wonder Forbes says options trading is "like finding money in the street."

How to Start Collecting Your Guaranteed $6,833 a Month Today

I'll show you all the ins and outs of my proven approach to options trading in my brand new special report, "5 Great Ways to Cash in on Options."

It gives you everything you need to start collecting guaranteed cash payouts every month—all with maximum safety and a minimum time commitment. Yes, just 9 minutes a week! It's yours free when you take Options for Income for a no-risk road test.

But that's not all: I'm so certain you'll love the steady income you'll be pocketing that I'll take it one step further—I'll guarantee you'll make $82,000 in the next 12 months on the trades I send you (if you trade 10 contracts per trade), or I'll send you a full refund on your subscription fee.

That's my personal guarantee. No tricks. No fine print.

Don't miss out.

Click here for full details on this one-of-a-kind offer now.

Editor's Note: As Jim mentioned, if you'd followed all of his recommendations since he launched Options for Income, you'd be sitting on an extra $282,320, assuming you traded 10 contracts on each one.

Imagine what you could do with a windfall like that. It's enough for a very nice new car (or two!), a down payment on a vacation home or that big trip you've always dreamed of. That's how powerful Fink's strategy is, and I don't want you to miss this chance to experience it.

Go here to learn more. | |  |

Most investors think trading options is too risky… too complicated… or too expensive. But there is a way to turn a couple hundred dollars into six figures… steadily. With this little-known trading strategy, we're profiting 84% of the time. (Forbes says 66% is considered excellent!) The strategy is so simple it takes just 9 minutes a week.

If you don't like risking your hard-earned money, then this is the ONLY options-trading strategy worth trying. Details are here.

| |  | 10/08/2014 By Chad Fraser

If you've been following the business news lately, you've probably heard a lot about spinoffs.

In fact, 2014 will see the largest number of corporate breakups in more than a decade. According to research firm Spin-Off Advisors, 62 spinoffs will likely be completed this year. To see a number higher than that, you have to go all the way back to 2000, when there were 66. This year's expected total is also far ahead of last year's tally of 37.

The trend looks like it will continue into next year, with a number of already-announced spinoffs poised to take effect in 2015.

Among them are eBay's (NasdaqGS: EBAY) recently announced plan to set up its PayPal payment-processing business as a separate company and Hewlett-Packard's (NYSE: HPQ) just-announced move to split its PC and printer units off as a separate firm.

Further on, we'll look at how spinoffs (and their parents) typically perform after going their separate ways, and whether a spinoff is a sign of a good investment.

But first, let's take a closer look at how spinoffs work and why companies undertake them.

Spinoffs in a Nutshell

A spinoff, as the name implies, occurs when a parent company turns one of its business units into an independent firm. There are a couple different ways it can go about this.

The usual course is for the parent to distribute 100% of its interest in the subsidiary to its own investors as a stock dividend. Typically, shareholders don't have to pay taxes on the shares of the new company they receive until they sell them.

A recent example is media giant Time Warner Inc. (NYSE: TWX), which completed the spinoff of its publishing business in June. Time Warner shareholders received one share of the new company, called Time Inc. (NYSE: TIME) for every eight Time Warner shares they held.

Another way a company can complete a spinoff is by letting its investors exchange their existing shares for stock in the new company, often at a discount.

Alternatively, a company could choose to carry out what's called an equity carve-out, or partial spinoff, where it sells a minority interest in a subsidiary (usually less than 20%) in an initial public offering (IPO).

In these cases, the newly spun off firm enjoys greater autonomy from the parent (with its own board of directors, CEO and financial statements) but still maintains close ties, so it benefits from the parent's expertise and resources. Carve-outs often result in full spinoffs later on.

One company that went this route is drug giant Pfizer Inc. (NYSE: PFE), when it divested its animal-health subsidiary, now called Zoetis Inc. (NYSE: ZTS).

In February 2013, Pfizer sold roughly 17% of Zoetis in an IPO. Then a few months later, it spun off its remaining stake by offering its shareholders the opportunity to swap their Pfizer shares for Zoetis stock at a 7% discount, giving them about $107.52 worth of Zoetis stock for every $100 of Pfizer shares they exchanged.

Breaking Up Has Benefits...

Numerous studies have shown that both spinoffs and their parent companies tend to perform well following a split.

For example, a 2012 Credit Suisse study examined companies involved in spinoffs over the previous 17 years and found that, on average, newly spun off firms outperformed the S&P 500 by 13.4% in the first 12 months after the breakup, while parents topped the index by 9.6%.

There are a number of ways spinoffs can unlock hidden value. For one, they allow each firm's management to zero in on its main business, something that investors---including activist investors---have been clamoring for in recent years.

"Over the past four or five years, there's been a push toward corporate clarity and a push toward getting back to core businesses," Robert Kindler, Morgan Stanley's (NYSE: MS) global head of mergers and acquisitions, told CNBC yesterday. "It's institutional investors as much as activists who want to have companies focus on a core business."

Accordingly, the new company's management, freed from the former parent's corporate structure, may be able to tap into new growth opportunities that were previously unavailable.

The PayPal spinoff provides an example. As a subsidiary, a certain segment of the fast-growing e-commerce market could be tough for PayPal to access, because companies like Amazon.com (NasdaqGS: AMZN) and Chinese powerhouse Alibaba Group (NYSE: BABA) are eBay competitors. However, as an independent firm, it's now free to pursue opportunities like these.

"One of the objectives of this is to give PayPal maximum flexibility to work with whomever they would like," eBay CEO John Donahoe said in a September 30 USAToday article. "How that works out we have no idea---but this allows PayPal that kind of independence and freedom."

...But the Early Days Can Be Choppy

Something else to keep in mind: even though they tend to outperform in the longer term, shares of both a spinoff and parent can turn in underwhelming performances in the days after the split goes into effect.

For example, the Credit Suisse study found that spinoffs underperformed the S&P 500 during the first 28 days before moving ahead of the benchmark, while parent firms took 27 days to do so. By day 60, both the parent and spinoff had returned on average 2.2% more than the S&P 500.

There are a number of possible explanations for this weakness. For one, investors are receiving shares in the new company---not choosing to buy them---and may feel the stock is inappropriate for them, prompting them to sell. Moreover, there is usually scant analyst coverage of the newly spun off firm, and outside investors may choose to hold off until the stock establishes more of a history before jumping in.

"You tend to see weakness early on as people sell it, and they're not familiar with the company," Paul Hickey, founder of Bespoke Investment Group, said in an August 21, 2013, CNBC article. "After a couple of weeks, the child usually outperforms the parent by a wide margin." | |  |

When Wall Street professionals need a guaranteed way to make money, they use this investing secret. Because they know it will help them win on 80% of their trades. I've used it to pull in $282,320 in extra cash since April 2011. Now you can use it, too – and make $6,833 in extra income every month, GUARANTEED. Click here to get started and collect your first $1,025 now.

| |  | 10/07/2014 By Robert Rapier

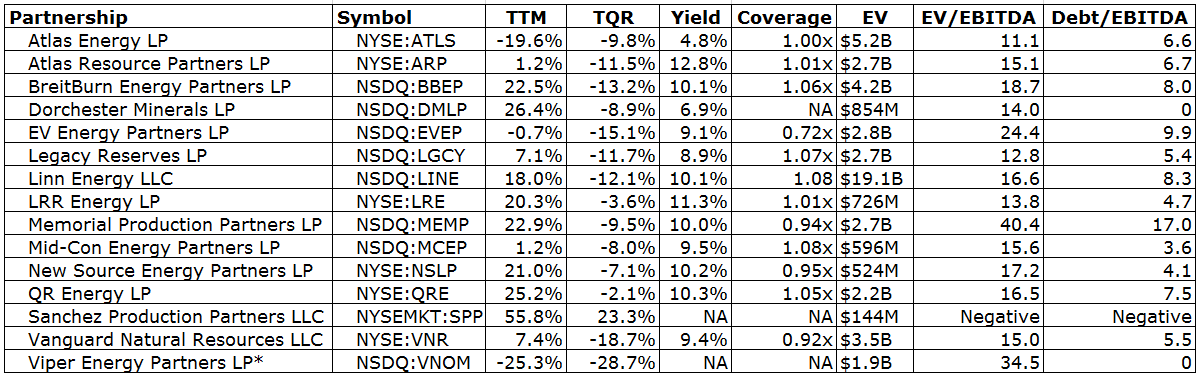

Most master limited partnerships (MLPs) operate in the "midstream" portion of the oil and gas business. "Midstream" refers to the transportation of oil and gas, and these midstream MLPs collect fees for providing the pipelines, storage tanks, etc. that move oil and natural gas from the production site to market. Midstream partnerships have less commodity exposure than "upstream" MLPs, which are those focused on the extraction of oil and gas. Because of the commodity exposure, investing in upstream MLPs entails more risk, but they also generally have higher yields than their midstream counterparts. While most midstream MLPs have yields in the 4% to 6% range, upstream MLPs commonly yield in the 8% to 12% range. But higher risk means more potential for losses when the markets turn against you. Declining commodity prices hurt the bottom line of upstream MLPs, and thus their ability to maintain or grow distributions. Most upstream MLPs use hedging to some degree to limit the commodity risk, but ultimately falling commodity prices will drag down their performance. Because oil and gas prices do not always trade in tandem, upstream partnerships can behave very differently based on the relative percentage of a partnership's production in oil and gas. According to the National Association of Publicly Traded Partnerships (NAPTP), there are 15 publicly traded partnerships engaged primarily in upstream operations. Most of these are engaged in oil and gas production, but Viper Energy Partners (NASDAQ: VNOM) owns mineral rights and relies on royalty payments for distributions.

*VNOM conducted its IPO on 6/18/14

TTM = Trailing Twelve Month total return through midday on 10/06/14 TQR is the total return over the past three months Coverage = Cash available for distribution divided by cash distributed EV - Enterprise Value in billion dollars on 10/06/14 EBITDA = Earnings Before Interest, Taxes, Depreciation and Amortization (TTM) Debt/EBITDA = Ratio of total debt to TTM EBITDA Except for Sanchez, all of these partnerships had positive earnings before interest, taxes, depreciation and amortization (EBITDA) over the past year. The average total return of the group for the past 12 months is +12.2%, with an average yield of 9.5%. But over the past 3 months as the price of West Texas Intermediate fell from near $105/barrel (bbl) to its current price around $90/bbl -- a decline of 14% -- the average upstream partnership has declined by 9.1%. Natural gas prices have held up better than oil prices in recent months. Natural gas is more subject to seasonal pricing, but relative to a year ago natural gas prices are about 10% higher (while WTI was still over $100/bbl a year ago). Thus, the upstream partnerships with a higher percentage of overall production in natural gas will probably have an easier time maintaining distributions in the third and fourth quarters. Investors looking for bargains in the upstream MLP sector should pay attention to the coverage ratios as third quarter distributions are announced. A significant deterioration in the coverage ratio could indicate that an upstream MLP is insufficiently hedged, and/or has a high percentage of its production as oil during this period of falling oil prices. MLPs whose coverage ratios hold up well would be near the top of my list for consideration, particularly if they are not overleveraged relative to their peers. This article originally appeared in the MLP Investing Insider column. Never miss an issue. Sign up to receive MLP Investing Insider by email. | |  |

Retiree Bob uses a little-known – and nearly foolproof – investing strategy to enjoy his retirement. Last year, he pulled in an EXTRA $110,000 – without touching his savings. That's cash! Today, he's relaxing in Maine. Bob says, "Trading this way sure beats being a greeter at Walmart." Now Bob "works" 9 minutes a week on this strategy. Discover Bob's six-figure retirement secret here.

| | |   | |

0 comments:

Post a Comment