Here at the end of the year, I like to look back at the top and bottom performing master limited partnerships (MLPs) since Jan. 1. The year was extremely volatile for the entire energy space, and MLPs were not spared. The severe price drop hit upstream MLPs especially hard. In fact, all but two of the 10 worst-performing MLPs for the year were in the upstream sector. Since there are still a few trading days left in the year the list may change slightly, but is unlikely to change substantially.

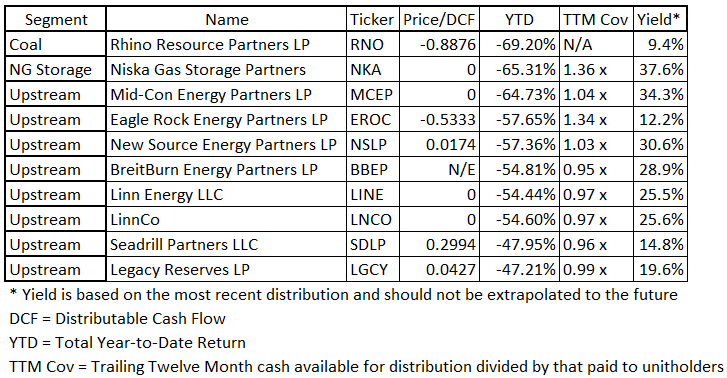

Here are the 10 worst performers for the year to date through Dec. 19, followed by commentary on the bottom five. Data is courtesy of MLP Data.

First, do note that these yields are based on distributions made under better business conditions than those prevailing currently. The deteriorating conditions have depressed unit prices, making the yields look much better than they are likely to be going forward. Most of these MLPs will likely see distribution cuts.

The worst performer for the year has been Rhino Resource Partners (NYSE: RNO), with a loss of 69.2%. This partnership is in the coal business, and that's been in the dumps for a few years now. In October, RNO announced a large distribution cut, and unit prices plummeted.

Niska Gas Storage Partners (NYSE: NKA) is down 65.3% YTD. The partnership has been plagued by earnings disappointments and declines in its fixed-fee revenue. On the conference call discussing the most recent quarterly results, the CEO warned that "in light of the continuing challenging conditions in the natural gas storage market, the board is reviewing the distribution level going forward and it is likely that the distribution will be reduced beginning this fiscal third quarter or suspended if current market conditions persist."

The next three on the list, Mid-Con Energy Partners (NASDAQ: MCEP), Eagle Rock Energy Partners (NASDAQ: EROC), and New Source Energy Partners (NYSE: NSLP) were down respectively 64.7%, 57.7%, and 57.4% respectively. These three partnerships are all engaged in the production of oil and gas. Even though most of Eagle Rock's production is natural gas, a 2013 distribution cut and the subsequent suspension of the distribution helped drive down the unit price over and above the decline due to commodity prices.

While 2014's big losers were concentrated in the upstream sector, there were still plenty of winners in 2014. Like the losers, the winners have a few things in common. I will discuss the top 10 MLPs of 2014 in next week's issue.

This article originally appeared in the MLP Investing Insider column. Never miss an issue. Sign up to receive MLP Investing Insider by email.

0 comments:

Post a Comment